Finance is often one of the most intimidating aspects of starting a small business — especially for first-time entrepreneurs. Many people are passionate about their idea, but unsure about managing money. Unfortunately, financial mistakes are one of the top reasons small businesses fail. That’s why understanding the basics of business finance is not just important — it’s essential.

In this article, we’ll explore the key financial concepts every new entrepreneur should know, including budgeting, cash flow, pricing, and financial planning — all explained in simple, clear terms.

Why Financial Knowledge Matters

Even if you’re not a “numbers person,” you still need to know where your money is going and how much is coming in. Without financial control, you can’t grow sustainably.

Good financial management helps you:

- Avoid running out of money

- Make smarter decisions

- Attract investors or partners

- Stay legally compliant

- Sleep better at night

You don’t need to be a finance expert — just master the fundamentals.

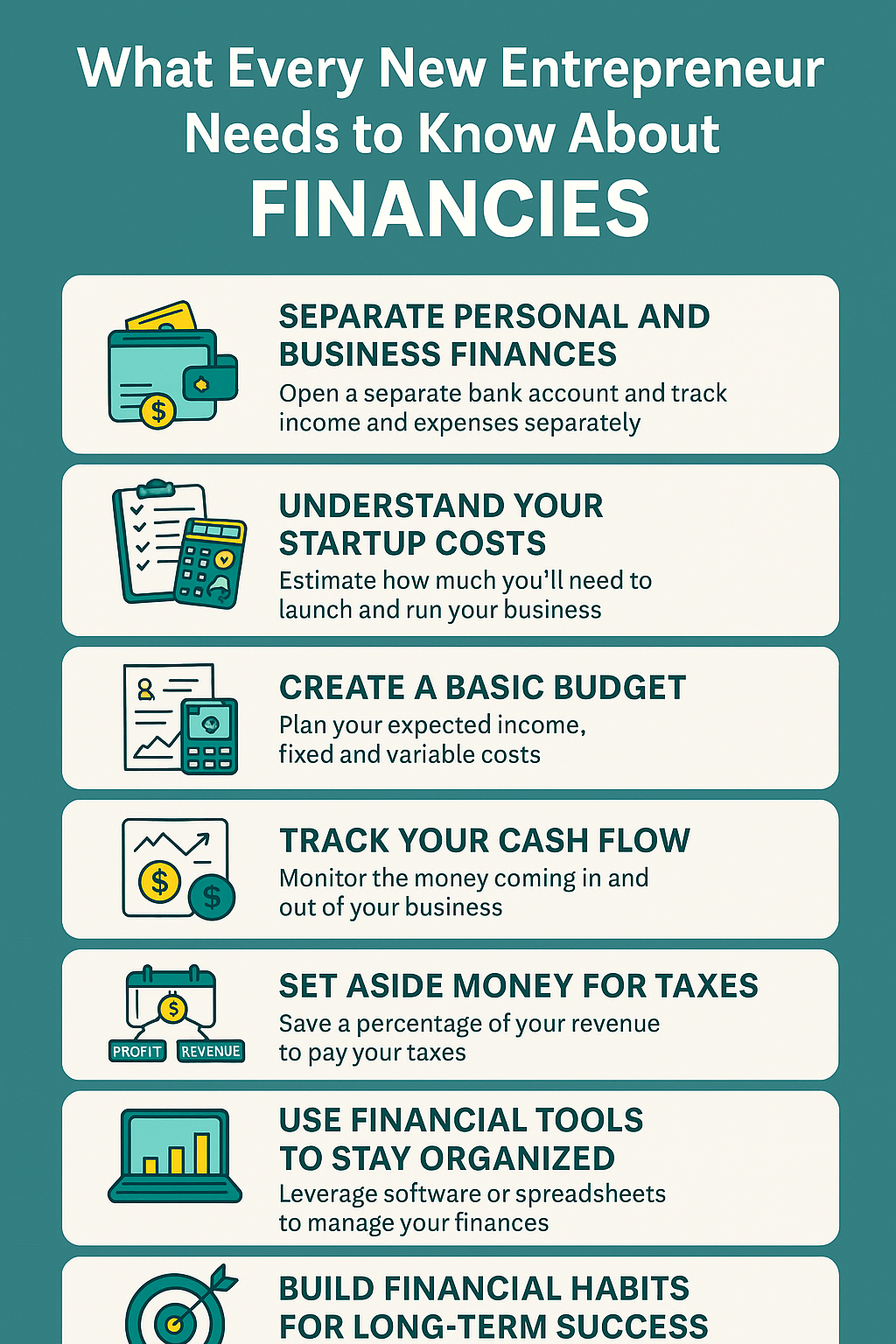

Separate Personal and Business Finances

This is one of the first things you should do when starting your business. Mixing personal and business money leads to confusion, poor tracking, and tax headaches.

What to do:

- Open a separate business bank account

- Use a dedicated card for business purchases

- Track your business income and expenses separately

This step alone will make your financial life much easier.

Understand Your Startup Costs

Before launching, make a list of everything you’ll need to spend money on. These are your startup costs.

Common examples:

- Business registration and legal fees

- Website or e-commerce setup

- Branding and marketing

- Tools and software

- Inventory or raw materials

- Equipment or office space

Estimate these costs carefully and try to start lean. Focus only on what’s necessary to launch and test your idea.

Create a Basic Budget

A business budget doesn’t have to be complicated. Start with a simple plan showing:

- Expected income (how much you think you’ll earn per month)

- Fixed expenses (rent, subscriptions, salaries)

- Variable expenses (marketing, packaging, utilities)

- Profit goals (what you want to keep after all costs)

Use tools like Google Sheets, Excel, or apps like Wave or QuickBooks to organize your numbers.

Track Your Cash Flow

Cash flow is the heartbeat of your business. Even profitable companies can fail if they don’t manage their cash flow.

Key tips:

- Always know how much money is coming in and going out

- Send invoices promptly and follow up on payments

- Avoid unnecessary expenses during low-revenue periods

- Keep a cash reserve for emergencies

Positive cash flow = business survival.

Learn to Price Your Products or Services Correctly

Pricing is not just about being cheaper than the competition. It’s about covering your costs and earning a profit — without scaring away customers.

How to calculate a price:

- Add all direct costs (materials, time, delivery)

- Add indirect costs (marketing, tools, rent)

- Add your desired profit margin

- Compare with market prices and adjust if needed

Don’t guess your price. Price based on numbers.

Set Aside Money for Taxes

Don’t get caught off guard by tax season. As a business owner, you are responsible for saving and paying taxes.

What to do:

- Learn what taxes apply in your region (income tax, sales tax, etc.)

- Set aside a percentage of your income each month (usually 15–30%)

- Keep all receipts and invoices for deductions

- Work with an accountant if needed

Being proactive about taxes saves you from trouble later.

Know the Difference: Profit vs. Revenue

Many new entrepreneurs confuse revenue (total sales) with profit (what you keep after expenses).

For example:

If you make $5,000 in sales but spend $3,500 on costs, your profit is $1,500 — not $5,000.

Always focus on profit, not just revenue.

Use Financial Tools to Stay Organized

You don’t need expensive software. Plenty of free or low-cost tools help you manage your finances efficiently.

Popular options:

- Wave – Free accounting and invoicing

- QuickBooks – Professional and scalable

- Zoho Books – Great for small teams

- Google Sheets or Notion – Simple but effective

Find what works for you and stick with it consistently.

Build Financial Habits for Long-Term Success

Good financial management isn’t about perfection — it’s about consistency.

Build habits like:

- Reviewing your numbers weekly

- Keeping track of every payment and receipt

- Analyzing your monthly performance

- Adjusting your prices or expenses when needed

The more you understand your numbers, the more confident you’ll feel about running your business.

Closing Thoughts: Don’t Fear Finance — Learn It

Money doesn’t have to be scary. When you treat your business finances with attention and respect, you’ll build a foundation for growth and stability.

You don’t need a finance degree. You need curiosity, organization, and a willingness to learn. Start small, build habits, and always stay aware of your financial health — your business will thank you for it.